Here's Why Outsourcing To CDMOs Doubled In 13 Years

By Erica Friedman, senior research analyst, BioPlan Associates

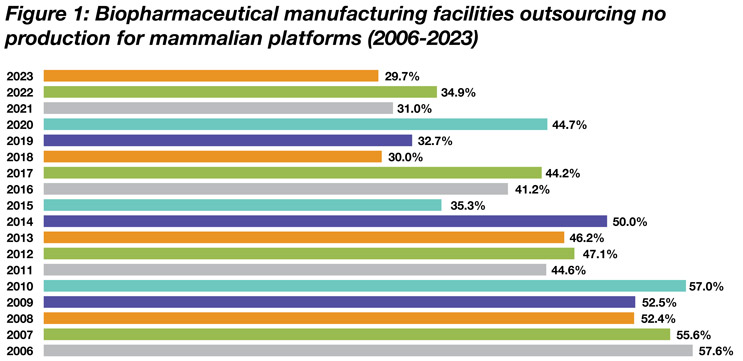

Only a minority of biologics are manufactured entirely in-house, and that percentage continues to decline. Biologics manufacturing has come to increasingly rely on biopharmaceutical contract manufacturing and development organizations (CDMOs) over the past 20 years that we have measured capacity and production. The primary manufacturing platforms, including mammalian cell culture, have experienced dramatic reductions in the percentage of production done in-house. According to the 20th Annual Report and Survey of Biopharmaceutical Capacity and Production, the percentage of mammalian platforms manufactured exclusively in-house, for example, declined from 57.6% in 2006 to only 29.7% in 2023 (see Figure 1).

CDMOs have become integral to the industry as many therapeutic innovators, especially newer and smaller companies, have neither the facilities nor the internal staff competence to see a biologic through the clinical pipeline to commercial scale. This trend can also be seen in the number of global CDMOs. Our database of global facilities includes over 1,500 bioproduction facilities and CDMOs.2 While the number of global facilities has grown relatively steadily over the past 15 years, the number of CDMOs in the past three years alone has expanded by around 20% to nearly 400 that are actively manufacturing clinical- or commercial-scale biologics globally.

Companies have already adopted outsourcing as a key part of their manufacturing strategies, rather than treating it primarily as a way to temporarily increase capacity or cut costs. Stresses caused by the pandemic and the post-COVID-19 manufacturing landscape have also highlighted the value of CDMOs.

Larger CDMOs were able to produce COVID vaccines and therapies to meet pandemic demand, but this often filled their capacity, creating capacity challenges so that other non-COVID projects ended up with mid-tier CDMOs. This cascade filled the industry’s capacity and extended wait times by many months.

Innovator companies seeking out CDMOs’ capabilities and expertise had to wait in line. This created an unprecedented demand for outsourced bioprocessing. Currently, wait times have moderated, and our data show capacity bottlenecks are abating.

On top of COVID activities, some CDMOs have continued to report as much as a 15% increase in business due to biosimilars, with most developers targeting the U.S. biosimilars market. As with generic drugs, multiple biosimilar manufacturers can be expected for each current product being produced, so there is likely be a rapid increase in the number of commercial biopharmaceutical products and manufacturers in coming years.

Source: 20th Annual Report and Survey of Biopharmaceutical Capacity and Production

Specific Areas Where Outsourced Bioprocessing Is In Demand

When a task requires specialized knowledge or equipment, CDMOs can offer an advantage for companies that lack the manufacturing capabilities to get biologics into clinical testing – a key feature of CDMOs’ ability to accelerate the regulatory approval process, specialized expertise, and increased capacity. Increased speed to market is one benefit of outsourcing, making it more appealing than merely using outsourcing to cut costs on low-value projects. BioPlan’s 20th Annual Report found a number of areas that drive use of CDMOs:

- need for access to enabling technology (e.g., expression systems, downstream processing)

- lack of internal expertise (available staff with specialized expertise)

- need to control budgets and funding

- need to avoid investing in facilities and staff

- need for increased capacity

- response to competitive pressures

- urgency: time-to-market

- avoiding technology licensing fees and royalties, e.g., for expression systems

- proven quality and regulatory experience and track-record of success

Key Activities Driving Outsourcing To CDMOs And CROs

Most outsourced manufacturing and testing activities have been outsourced at greater rates over the past 13 years. However, of the 26 areas we evaluated, some notable areas appear to be growing more rapidly, including:

- analytical testing,

- regulatory services,

- API biologics manufacturing,

- cell line development,

- media optimization,

- downstream process development, and

- quality by design services.

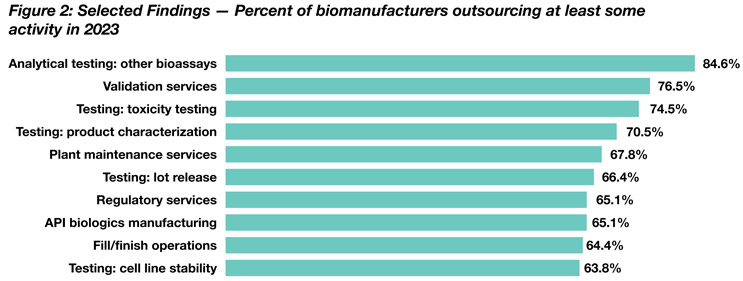

Many of these have grown from 20% to 25% outsourced to 50% to 60% over 13 years. More commonly outsourced CRO services such as analytical testing show more moderate growth because they had already been outsourced at high rates in prior decades.

Source: 20th Annual Report and Survey of Biopharmaceutical Capacity and Production

Of commonly outsourced services, the No. 1 position is taken by “analytical testing: other bioassays,” followed by “validation services” (84.6% and 76.5% of respondents, respectively).

Growth Trends In Outsourced Services

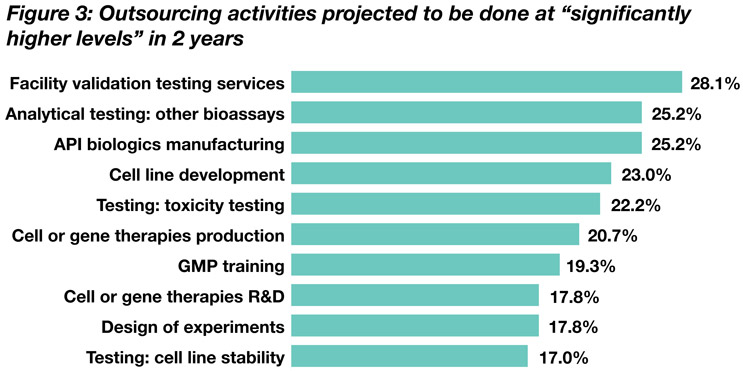

Looking at growth trends, we also asked respondents where they expect greater outsourcing to occur in the next 24 months (see Figure 3). Respondents believe the top five growth areas for outsources activities through 2025 are:

- facility validation testing services

- analytical testing: other bioassays

- API biologics manufacturing

- cell line development

- testing: toxicity testing

Areas where respondents project the greatest growth rates through 2025 include, for example, 28.1% of respondents noting facility validation testing services will be done at “significantly higher levels” in the next 24 months. There are near-term indicators of where facilities are planning more outsourcing in the next 24 months. The top six activities cited are already being outsourced by two-thirds or more of respondents. The data show some interesting shifts in priorities.

Source: 20th Annual Report and Survey of Biopharmaceutical Capacity and Production

“Facility validation testing services” comes in at No. 1 here, with 28.1% of respondents. This category is up from 26.3% in the 2021 survey. “Facility validation testing” and “analytical tests/bioassays” remain among pivotal needs, but “cell line development” fell from 28.1% to 23.0% of respondents, yet still holds at No. 4.

We also saw recent increases in demand for certain outsourced services. The largest increases this past year included:

- toxicity testing, 22.2% in 2023, up from 14.6% in 2022

- GMP training, 19.3%, up from 11.5% in 2022

- design of experiments, 17.8%, up from 12.5% in 2022

Onshoring Global Biomanufacturing

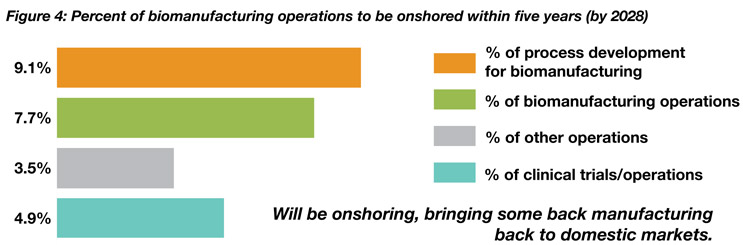

Despite recent public and private initiatives regarding onshoring and returning of manufacturing operations to domestic locations, offshoring of many services continues to show significant growth. Report data show that about 8% of respondents will be “onshoring” their biomanufacturing in the next five years. On the other hand, over one-fifth (20.3%) indicated they will offshore a majority (over 50%) of their biomanufacturing operations to India, China, or another lower cost country over the next five years. This compares to 11.2% of respondents planning to offshore the majority of their “process development operations.”

These new bioprocessing regions include developing and other countries, which currently may lack strong bioprocessing infrastructure, especially GMP-capable bioprocessing CDMOs. Respondents considering international outsourcing expect and require cGMP standards as a priority, significantly more than they look for potential for cost savings. These new regions will have to step up in cGMP to catch up to U.S. and European companies to compete in the expansion of outsourcing.

Source: 20th Annual Report and Survey of Biopharmaceutical Capacity and Production

The United States still leads the world in terms of capacity and expertise dedicated to innovative products and services in contract manufacturing. This year we have seen considerable expansion in European countries such as Germany and France, as well as China, India, and Singapore. We see also that Singapore is a more likely destination than other Asian regions or many European countries.

Biologics is an international industry. Well-established European companies dedicated to producing pharmaceutical products currently dominate the European market. Yet many have invested heavily in international markets. Large Asian organizations have established biomanufacturing capacity serving domestic and regional needs – some are also expanding to Europe and the U.S. Increases in both public and private investment in the region in the past decade have resulted in expanded biopharmaceutical capacity as the industry responds to need for better healthcare, growing middle class economies around the globe, and most recently to pandemic demands.

Global demand in the industry has generally pushed contract manufacturers to increase production capacity and, in developed regions, the need for technical capabilities to tackle more highly specialized tasks such as cell and gene therapy continues to grow. CDMOs and CROs in China, India, and the ROW are slowly becoming more common as these domestic organizations begin to fill the needs of local biomanufacturers.

Conclusions

Outsourcing to CDMOs was generally initiated in the ’90s when the biopharmaceutical industry was still relatively young. Many organizations lacked the facilities to develop and produce products at commercial scale. Some early CDMOs, such as Lonza, had large bioprocessing capacity and a few others also had full know-how to bring a product to regulatory agencies for approvals and to perform subsequent commercial manufacturing.

Around 20 years ago, there were dire concerns about a worldwide bioprocessing capacity shortfall or “capacity crunch,” which never fully developed. At that time, the options were to build your own facility, or use a CMO. That has continued as small, younger biologics innovators need partners, access to facilities, and knowledge to enable them to reach clinical stages. Today, a similar situation exists for companies developing innovative cell and gene therapies.

Outsourcing of bioprocessing will continue to expand in importance as innovators/developers seek to get their biologics to the market quickly and cost-effectively. More established companies will continue to search for partners to outsource their products, to free up their internal pipelines and capacity. Expansions of CDMO facilities and capacity are needed for new(er) product technology areas, such as cellular and gene therapies, antibody-drug conjugates (ADCs), and pandemic vaccines and therapeutics. Demand for unique CDMO services is increasing as the adoption of newer technologies, such as improved downstream and continuous bioprocessing, and cell-free bioprocessing increases. This will likely expand the need for specialized validation and manufacturing services.

New manufacturing platforms are expanding the CMO industry. For example, plant expression systems are slowly becoming practical alternatives to more standard mammalian cell platforms. Vaccines and other products manufactured at highest volumes will likely be the area first and most affected by plant-based manufacturing platforms.

In developing countries, and in niche services, our Top 1000 Global Biopharmaceutical Index has shown the expansion of CDMO service capacities. Although the great majority of these service providers offer only early-stage research and development and manufacturing services, or only support early clinical-scale GMP manufacturing, a few have the capabilities and expertise to provide commercial-scale U.S./EU GMP-level product manufacturing services.

Overall, these factors point to the bioprocessing CDMO segment as having a promising and profitable future.

References:

20th Annual Report and Survey of Biopharmaceutical Capacity and Production, BioPlan Associates, Inc. April 2023, Rockville, MD, USA, www.bioplanassociates.com

Top1000bio Database of Global Biopharmaceutical Facilities, BioPlan Associates, Inc. Accessed September 27, 2023, Rockville, MD, USA, www.Top1000bio.com

About the Author:

Erica Friedman, senior research analyst at BioPlan Associates, Inc., has 30 years of experience in research in the pharmaceutical and biotech industries. She has an MLIS from Rutgers University.